Step-by-Step: How To Make a Balance Sheet Chase for Business

Content

Knowing how to create and read a company’s balance sheet is essential to understanding the state of a business. You can generate a balance sheet for any specified period — many companies will create a multi-year balance sheet that compares how a firm has progressed over its recent history. Review the above balance sheet example from Apple, Inc., to understand how to read a balance sheet. Regardless of the company’s size, a balance sheet should be clear and straightforward. Both columns list their line items with a total that equals the other, to balance.

AHLA: 82% of surveyed hotels report staffing shortages – Hotel Management

AHLA: 82% of surveyed hotels report staffing shortages.

Posted: Tue, 06 Jun 2023 12:08:45 GMT [source]

A clear snapshot of your business’s financial performance can help you secure funding, obtain loans, and, for so many reasons, reduce headaches. To have a more thorough look at how double-entry bookkeeping works, head to FreshBooks for a gallery of income statement templates. Now that we have seen some sample balance sheets, we will describe each section of the balance sheet in detail. Our Pledge to YouGuidant Financial takes an educational and transparent approach to small business and franchise financing.

Overview of Financial Statements

For example, potential investors or stakeholders may be more convinced to invest in your business if you prove profitability. This balance sheet also reports Apple’s liabilities and equity, each with its own section in the lower half of the report. The liabilities section https://www.bookstime.com/articles/how-to-make-a-balance-sheet is broken out similarly as the assets section, with current liabilities and non-current liabilities reporting balances by account. The total shareholder’s equity section reports common stock value, retained earnings, and accumulated other comprehensive income.

Using a balance sheet template will streamline the next step of the process, so that you don’t have to manually insert all of the fields yourself. This is a vital step towards understanding the core strength of a company, and to assess the business performance. The balance sheet tells you what your business owns and what it owes to others on a specific date.

What’s on a balance sheet?

Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt. The remaining amount is distributed to shareholders in the form of dividends. The balance sheet provides an overview of the state of a company’s finances at a moment in time. It cannot give a sense of the trends playing out over a longer period on its own. For this reason, the balance sheet should be compared with those of previous periods. Investing in securities products involves risk and you could lose money.

This article is for anyone who wants to understand how to prepare a balance sheet, which is often used by investors, creditors, and management. We explain why and how to create https://www.bookstime.com/ one as well as suggest technology tools to simplify your job. Below are balance sheet templates that you can use with Microsoft Excel to create one for your business.

Sample Balance Sheet

Shareholders’ equity is the combination of share capital plus retained earnings. In the early stages, it’s normal to have a negative balance in stockholder equity—liabilities (i.e., your startup costs) are higher than your assets. You may invest $50,000 in your business before you ever launch to the public. You could be in the early stages of buying product inventory, building an app, or designing a website.

Please refer to the Payment & Financial Aid page for further information. Do you want to learn more about what’s behind the numbers on financial statements? Explore our finance and accounting courses to find out how you can develop an intuitive knowledge of financial principles and statements to unlock critical insights into performance and potential. We explain the why and how behind filling out a balance sheet when getting a land loan.

A small business guide to creating a balance sheet

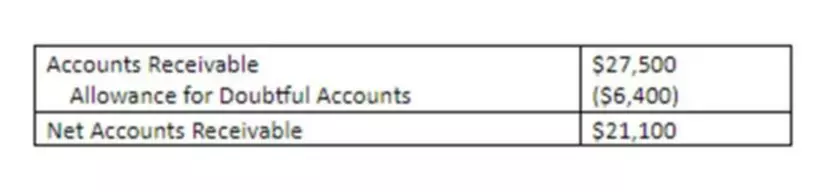

Beneath the assets are the liabilities followed by stockholders’ equity. Download our FREE Small Business Balance Sheet Template to start and follow along! Our template also includes automated common financial ratio calculations, making your life easier.

The additional column allows the reader to see how the most recent amounts have changed from an earlier date. Amita Jain is a writer at Capterra, covering the branding and accounting markets with a focus on emerging digital enablement tools and techniques. A public policy graduate from King’s College London, she has worked as a journalist for an education magazine. Her work has been featured by Gartner and Careers360, among other publications. Swimming, doodling, and reading fiction are her happy distractions outside of work.

Owner’s or stockholders’ equity.

You’ve also taken $9,000 out of the business to pay yourself and you’ve left some profit in the bank. Equity can also drop when an owner draws money out of the company to pay themself, or when a corporation issues dividends to shareholders. You can also compare your latest balance sheet to previous ones to examine how your finances have changed over time. These ratios help evaluate a company’s liquidity, solvency, and efficiency. For a detailed understanding, compare these ratios with industry benchmarks or historical data to identify trends and potential risks.

- A lower equity ratio means you have more assets financed by other lenders than you have of your own cash in the asset.

- Shopify then takes a percentage of the merchant’s future sales to pay back the loan.

- A balance sheet for a typical accounting period (12 months) would reflect the number of assets and liabilities when the period ends.

- This shows your assets—which is what you own, your liabilities—which is what you owe, and your owner’s equity—which is yours and your partners’ investment in the business.